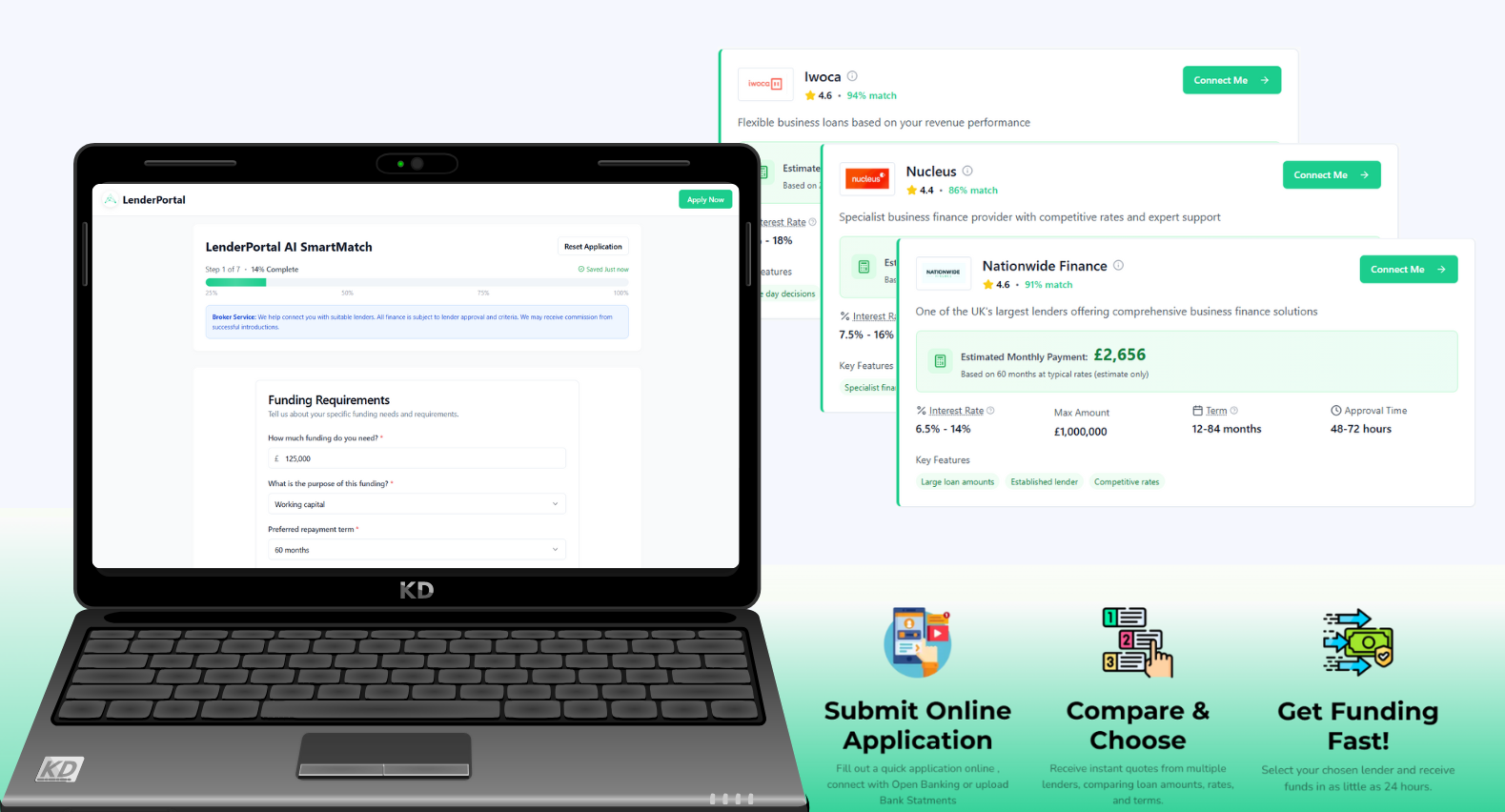

The platform checks eligibility across multiple lenders, presenting instant options that match your business’s needs.

It’s speedy, cost-free, and won’t influence your credit score.

The platform is important because it provides transparency and control in the funding journey, allowing businesses to make informed decisions quickly and efficiently.

It eliminates bias by offering multiple options from various lenders, and it’s free to use, with no credit impact. By streamlining the process and providing valuable insights, the platform helps businesses achieve financial stability and growth.

We partner with top-tier lenders to provide businesses with financial support

Simply fill out our online application form with basic business information, and our system will match you with suitable lenders. You’ll receive multiple loan offers, and you can compare rates, terms, and conditions before choosing the best option for your business.

Loan amounts vary depending on the lender and your business needs. Typical loan terms range from 3 months to 6 years.

Some lenders may consider applications from businesses with bad credit, but it may affect the interest rate or loan terms offered.

Some lenders may offer unsecured loans, while others may require collateral. We’ll match you with lenders that fit your needs.

Funding times vary depending on the lender and your approval status. Some loans can be funded in as little as 24 hours, while others may take up to a week or more.

Stay connected with us:

Reviews

Disclaimer: Lender Portal is a credit broker that connects UK businesses with a range of lenders. We work closely with businesses and their trusted advisors to provide access to business finance solutions. While we do not provide loans or other financial products ourselves, we can introduce you to a selection of providers that may be suitable for your needs. We may receive commission from the lenders we introduce you to, should you proceed with an application, and applicants must be at least 18 years old and meet specific terms and conditions to be eligible for our services. Guarantees and indemnities may be required by some lenders as part of their lending criteria. Lender Portal is registered with Companies House (Company Number: 15871826) and is based at 71-75 Shelton Street, Covent Garden, London WC2H 9JQ. By using our services, you acknowledge that you have read and understood these terms and conditions, and agree to be bound by them. ICO number: ZB727660